You can lodge a grievance letter with the income-tax authorities with your complaint on wrong assessment of your income-tax return, and wrong calculation of the tax liability/ refund amount.

If your grievance is not satisfactorily addressed, then you can write to the jurisdictional IT Ombudsman with the details of your name, PAN, address, assessment year, facts about your complaint with proofs, earlier complaints dates and addressed to, and relief requested.

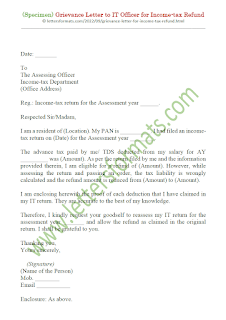

Here is an example of a grievance letter to the Income-tax officer for a tax refund and dissatisfaction with the way your tax return was assessed.

TEMPLATE

Date: _______

To

The Assessing Officer

Income-tax Department

(Office Address)

Reg.: Income-tax return for the Assessment year ______.

Respected Sir/Madam,

I am a resident of (Location). My PAN is __________. I had filed an income-tax return on (Date) for the Assessment year ________.

I am enclosing herewith the proof of each deduction that I have claimed in my IT return. They are accurate to the best of my knowledge.

Therefore, I kindly request your goodself to reassess my IT return for the assessment year _______ and allow the refund as claimed in the original return. I shall be grateful to you.

Thanking you,

Yours sincerely,

(Signature)

(Name of the Person)

Mob. ________

Email ___________

Enclosure: As above.

I am the victim of a highly unjustified tax assessment by the tax authority. I have lodged a complaint with the tax department. Your format was useful in this aspect.

ReplyDelete