In order to appear before any statutory authority on behalf of someone else, you would need a written authorisation letter from that person.

The authorisation letter should be duly signed and also sealed, if needed. The letter should accompany self-attested identification proofs of both the person authorising it and the authorised person.

Here are samples of such authorisation letters to appear before income-tax officers and to deal with all income-tax matters on behalf of a taxpayer.

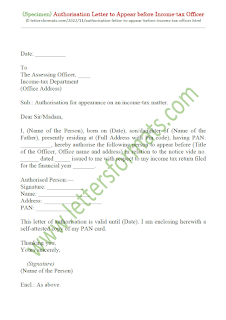

TEMPLATE #1

Date: __________

To

The Assessing Officer, ____

Income-tax Department

(Office Address)

Sub.: Authorisation for appearance on an income-tax matter.

Dear Sir/Madam,

I, (Name of the Person), born on (Date), son/daughter of (Name of the Father), presently residing at (Full Address with Pin code), having PAN: __________, hereby authorise the following person to appear before (Title of the Officer, Office name and address) in relation to the notice vide no. ______ dated _____ issued to me with respect to my income tax return filed for the financial year _______.

Authorised Person:—

Signature: ____________

Name: _________________

Address: ___________________

PAN: ____________

This letter of authorisation is valid until (Date). I am enclosing herewith a self-attested copy of my PAN card.

Thanking you,

Yours sincerely,

(Signature)

(Name of the Person)

Encl.: As above.

TEMPLATE #2

To Whom It May Concern,

I, (Name of the Person), born on (Date), son/daughter of (Name of the Father), presently residing at (Full Address with Pin code), having PAN: __________, hereby authorise the following person to handle my income tax matters for the financial year _______.

Authorised Person

Signature: ____________

Name: _________________

Address: ___________________

PAN: ____________

This authorisation is granted until further notice for the following matters only:

i) to sign my income tax return on my behalf,

ii) to submit my bank account details for receipt of tax refunds,

iii) to log in to the official website of the income-tax department for filing my return and submitting any other important information and documents as may be required,

iv) to appear before the income-tax officer and any other statutory officer in relation to my income-tax return or any other case for which income-tax office might issue notice to me,

v) to execute any other documents in relation to the above with my prior permission.

I hereby declare and affirm that the information provided herein-above is correct and complete to the best of my knowledge and belief. I am enclosing herewith a self-attested copy of my PAN card for verification purposes.

Sincerely,

(Signature)

(Name of the Person)

Date: _________

Place: _________

Comments

Post a Comment

Leave your comments and queries here. We will try to get back to you.